KJR Management formally established the Environmental Charter in June 2013, which sets out our environmental principles and action plans.

We consider the Earth itself to be our most important stakeholder and are continually working towards the realization of a sustainable society through our business activities.

The Paris Agreement is an international framework on climate change adopted in 2015. Its long-term goal is stated as holding the increase in the global average temperature to well below 2ºC above pre-industrial levels and sharing efforts to limit the temperature increase to 1.5ºC, and to achieve effectively zero greenhouse gas emissions.

Actions related to climate change accelerated in 2021. For example, the U.S.-hosted Leaders Summit on Climate was held, and climate change was discussed as the most important issue in the G7 Summit. In addition, the Intergovernmental Panel on Climate Change (IPCC) affirmed in its latest report released in August that “it is unequivocal that human influence has warmed the atmosphere.” Thus, it was revealed that significant reductions in greenhouse gas emissions are urgently needed to achieve the Paris Agreement goals. Under such circumstances, the 26th Climate Change Conference of the Parties (COP26) was held. The final agreement clearly states that the conference “reaffirms the goal to pursue efforts to limit the temperature increase to 1.5ºC,” indicating that not only governments but also industries will need to consider measures for the 1.5ºC target going forward.

In June 2013, KJR Management established the Environmental Charter and the Sustainability Policy. The Environmental Charter clearly states that we will work toward net zero emissions to respond to climate change “by implementing new efficiency measures and technologies, engaging in dialogue with stakeholders, and other efforts, while reducing greenhouse gas emissions and taking on climate change via both mitigation and adaptation.” In addition, the Sustainability Policy, which sets forth principles of action concerning sustainability, stipulates that we “implement Responsible Property Investment (RPI) that integrates environmental, social, and governance (ESG) elements into property investment.” This concept of RPI is incorporated into and carried out throughout the entire period of funds’ investment and management processes.

The Company recognizes that climate change is an important environmental issue that significantly impacts our business activities. Global warming is becoming more severe with increasing economic activities, and various researches have made clear that this leads to abnormal weather such as torrential rains, floods, and droughts.

Our mission is “creating, through real estate investment management, new demand in our society and new value that exceeds people’s expectations.” To achieve our mission, it is necessary to create a sustainable society, and we recognize that the shift to a low-carbon society is a social responsibility required from long-term management.

The Company expressed support for the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD)* in August 2019 and has been advancing initiatives based on the recommendations.

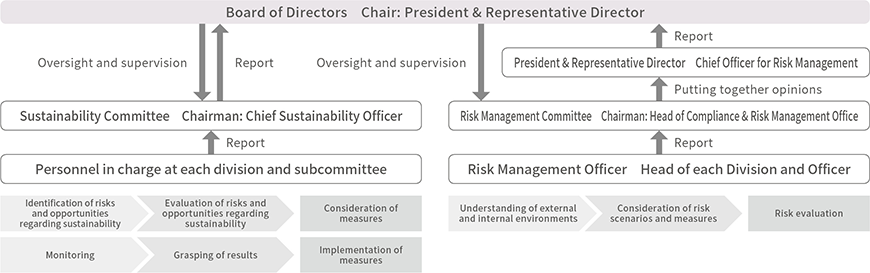

The matters resolved by and reported to the Sustainability Committee chaired by the Chief Sustainability Officer (CSO) are overseen and supervised by being reported as needed to the Board of Directors, which meets at least once every three months and is chaired by the President of the Company, as well as the Board of Directors of each investment corporation, which meets at least twice a month in principle.

The Sustainability Committee, which held once a quarter in principle, identifies material risks and opportunities related to sustainability including climate change, and plays a central role in sustainability activities by resolving policies, strategies, systems, and sustainability goals and monitoring performance.

Please click here for more information.

With regard to climate change-related risks and opportunities for each investment corporation, led by the sustainability staff of each division, we first examine their impact on our portfolio and the possibility of their occurrence, and then identify the risks and opportunities closely related to each investment corporation and examine their impact. The identified risks, opportunities and their degree of impact are reported to and discussed at the Sustainability Committee and the identification and evaluations of risks and opportunities are confirmed.

The Company led by the person in charge of sustainability issues, holds meetings (hereinafter referred to as "subcommittees") as necessary to discuss and examine in detail sustainability-related issues and promotion methods at the working level, either within the division or in cooperation with other divisions. Through the subcommittees, individual issues are discussed, and information is shared to raise awareness and understanding of the issues among those in charge, and to integrate sustainability considerations into the daily investment and management process.

Matters considered by the subcommittees are reported to the Sustainability Committee on the basis of submissions from the divisions, and the Sustainability Committee reviews progress in addressing the assessed risks and opportunities.

Moreover, each investment corporation collects and monitors monthly environmental data for properties. To work on initiatives for environmental matters, including metrics and targets and efforts to address climate change, and collect environmental data, we have established an environmental management system and strive to continually strengthen and improve our initiatives by implementing a PDCA cycle.

We operate the Risk Management Committee, in which senior management personnel serve as members. The Committee grasps and investigates matters related to major risks and formulates countermeasures and management policies. It checks the risks affecting business operations, including climate change, at each division once every two months using a Risk Control Matrix (RCM), and reports to the committee for evaluation and management.

We consider that responding to climate change is an important social issue that significantly impacts our business activities. In order to clarify the risks and opportunities arising from climate change and to examine the financial impact and countermeasures, we conducted a medium and long term scenario analysis for each portfolio of each investment corporation, referring to the 4°C and 1.5°C climate-related scenarios in the International Energy Agency (IEA) reports and IPCC assessment reports.

Please refer to the sustainability pages of JMF and IIF for the latest information on scenario analysis for each investment corporation.

Below is a description of our perception of the challenges tied to climate change-related risks and opportunities in the real estate industry, including J-REITs.

This table can be scrolled left and right.

| Classification based on TCFD | Narrow Classification | Period | Understanding of Issues |

|---|---|---|---|

| Transition Risks | |||

| Policies, and legal |

|

Medium term Long term |

|

| Technology |

|

Medium term Long term |

|

| Markets |

|

Medium term Long term |

|

| Reputation |

|

Medium term Long term |

|

| Physical Risks | |||

| Acute |

|

Medium term Long term |

|

| Chronic |

|

Long term |

|

| Opportunities | |||

|

Medium term Long term |

|

|

To reduce the impact of the physical risk, we are taking measures to improve building resilience, such as the installation of waterproof boards and portable storage batteries. We are also actively responding to climate change by introducing renewable energy. In addition, we are considering the utilization of the Carbon Risk Real Estate Monitor (CRREM) and use of other simulation tools in calculating the impact of climate change risk on our portfolio.

Reduce absolute Scope 1+2 emissions by 42% by 2030 (compared with 2020)

Aim for net-zero absolute GHG emissions throughout the entire value chain by 2050

Reduce absolute Scope 1+2 emissions by 42% by 2030 (compared with 2021)*

Aim for net-zero absolute GHG emissions throughout the entire value chain by 2050

Aim to reach carbon neutrality by 2050

Reduce CO2 emissions by 2030

For results and progress since 2015, please refer to JMF or IIF Environmental Performance page. For other indexes and goals, please refer to KJR Management, JMF or IIF “Materiality and KPIs” in Sustainability.