The matters resolved by and reported to the Sustainability Committee chaired by the Chief Sustainability Officer (CSO) are overseen and supervised by being reported as needed to the Board of Directors of KJRM Holdings, which is chaired by the President & CEO who also serves as CSO and meets at least once every three months, as well as the Board of Directors of the investment corporation, which meets at least twice a month in principle.

The Sustainability Committee, which held once a quarter in principle, identifies material risks and opportunities related to sustainability including climate change and natural capital, and plays a central role in sustainability activities by resolving policies, strategies, systems, and sustainability goals and monitoring performance.

For details, please refer to “Sustainability Promotion Structure”.

Dependencies and impacts as well as risks and opportunities on climate change and natural capital are sorted out in consideration of KJRM's business activities and then reviewed for each investment corporation, led by the sustainability staff of each division. Dependencies and impacts as well as identified risks and opportunities, along with their degree of impact, are reported to, and discussed and confirmed by the Sustainability Committee.

KJRM led by the person in charge of sustainability issues, holds meetings (hereinafter referred to as "subcommittees") as necessary to discuss and examine in detail sustainability-related issues and promotion methods at the working level, either within the division or in cooperation with other divisions. Through the subcommittees, individual issues are discussed, and information is shared to raise awareness and understanding of the issues among those in charge, and to integrate sustainability considerations into the daily investment and management process.

Matters discussed and considered by the subcommittees are reported to the Sustainability Committee by each division, and the Sustainability Committee monitors that progress.

Moreover, each investment corporation collects and monitors monthly environmental data for properties. To work on initiatives for environmental matters, including metrics and targets and efforts to address climate change, and collect environmental data, we have established an environmental management system and strive to continually strengthen and improve our initiatives by implementing a PDCA cycle.

KJRM operates the Risk Management Committee, in which senior management personnel serve as members. The Committee grasps and investigates matters related to major risks and formulates countermeasures and management policies. It checks the risks and opportunities affecting business operations, including climate change, at each division once every three months using a Risk Control Matrix (RCM), and reports to the committee for evaluation and management.

We recognize the critical importance of what ecosystems can provide and are committed to protecting ecosystems and mitigating any potential impacts on biodiversity.

We recognize that human life and economic activities are based on natural capital, including biodiversity. We will continue to examine the relationship between our business activities and natural capital with reference to the TNFD recommendations.

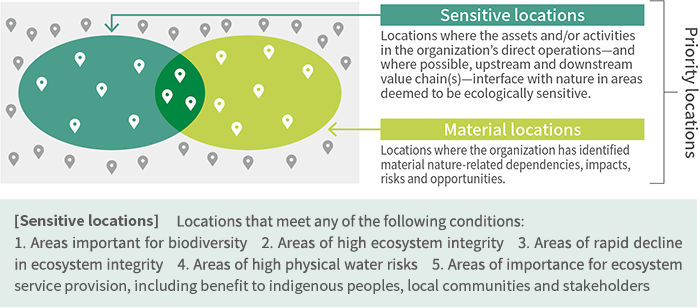

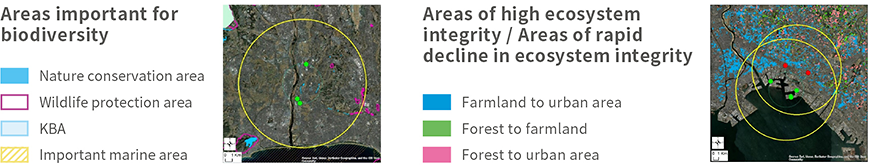

The TNFD recommendations favor the LEAP approach as a means of identifying and assessing the relationship between business activities and nature. This process was used to analyze the dependencies and impacts of our business activities on nature and to select potential priority locations.

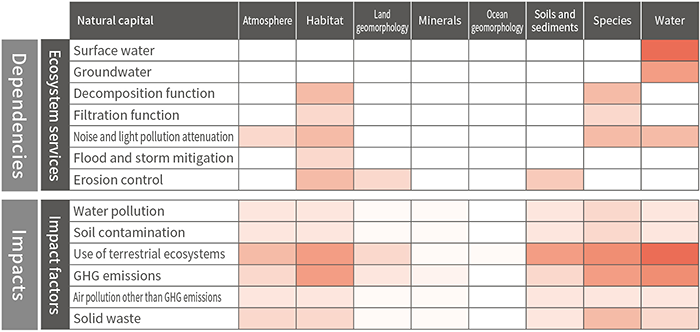

The TNFD recommendations encourage the use of the ENCORE tool to identify dependencies and impacts on natural capital in our operating sectors. Referring to real estate management as the sector in which we have direct operations, we considered the dependencies and impacts on natural capital that ought to be considered. In its considerations, we took account of the status of the relevant actions taken in each fund, in reference to the real estate management sector. After that, it identified dependencies and impacts.

In our current review, although we have analyzed high dependency items as not applicable, we believe that land use in our real estate operations has the potential to have a high impact on species, water, and habitat through the impact factors of use of terrestrial ecosystems and GHG emissions. We anticipate that these impacts pose a risk of land use change due to climate change, such as the occurrence of fires and floods.

The TNFD recommendations favor the LEAP approach as a means of identifying and assessing the relationship between business activities and nature. This process was used to analyze the dependencies and impacts of our business activities on nature and to select potential priority locations.

This table can be scrolled sideways.

| Fund | Area | Number of properties | Segment |

|---|---|---|---|

| JMF | Omotesando | 13 properties | Urban retail / Mixed-use |

| Narashino | 2 properties | Urban retail / Mixed-use | |

| Fujisawa – Sagami River | 13 properties | Residence | |

| Osaka | 1 property | Urban retail / Mixed-use / Office / Residence | |

| IIF | Narashino | 4 properties | Logistics facilities / Manufacturing and R&D facilities, etc. |

| Fujisawa - Sagami River | 4 properties | Logistics facilities / Manufacturing and R&D facilities, etc. | |

| Osaka | 4 properties | Logistics facilities |

We recognize the critical importance of what ecosystems can provide and are considering initiatives at properties held by JMF and IIF to help protect ecosystems and mitigate any potential impacts on natural capital. The initiatives we are promoting in relation to preserving biodiversity at properties include the establishment of green zones, consideration for the use of native species, and management of green space in accordance with the Green Space Management Manual.