As an asset management company, KJR Management receives asset management consignments from JMF and IIF is committed to upholding its fiduciary duty to investment corporations.

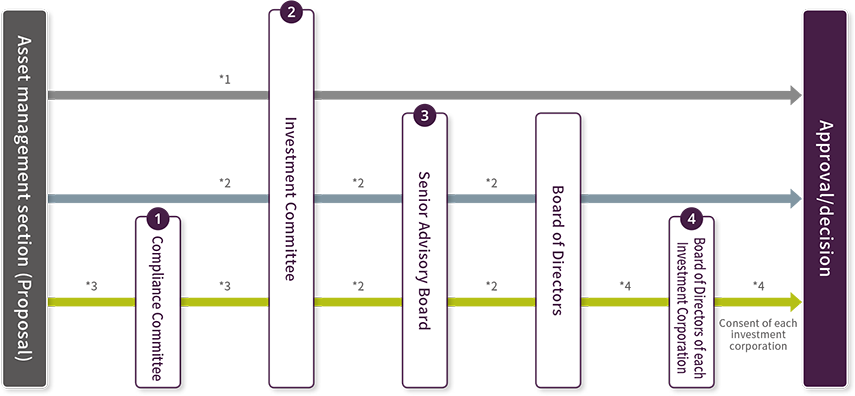

In the course of making decisions regarding the acquisition, di sposal, or operation and management of assets, approval is obta ined from the Investment Committee and the Senior Advisory Boar d/Board of Directors in accordance with the Guidelines for the Investment Committee, Rules of the Senior Advisory Board (the “Senior Advisory Board Rules”) and the Rules of the Board of Directors. Furthermore, in the course of making decisions regarding investment policies and standards, operation and management policies and standards, budget, and financing of each investment corporation, the Investment Committee makes decisions, and a proposal is submitted to the Senior Advisory Board for approval in accordance with the Senio r Advisory Board Rules. If a transaction constitutes a transact ion between stakeholders stipulated in the Regulations for Tran sactions with Stakeholders of the Asset Manager, the Compliance Committee must first adopt resolutions before the Investment Committee makes decisions (excluding transactions that meet certain minor requirements as stipulated in the Regulations for Transactions with Stakeholders, (“Minor Transactions”)). In addition, if a transaction to be executed involves the acquisition, disposal, or lending of securities or real estate between any investment corporation and a related party of the like of the Asset Manager as stipulated in Article 201(1) of the Investment Trust Act (“ITA”), then, subsequent to the Compliance Committee adopting a resolution and the Investment Committee adopting a resolution, each Investment Corporation’s consent must, by the time the transaction is executed, be obtained based on the approval of the Board of Directors of each Investment Corporation, except in certain cases in which it is determined that the transaction will have a minor impact on each Investment Corpora tion’s assets.

| ①Compliance Committee | ②Investment Committee | ③Senior Advisory Board | ④Board of Directors of each Investment Corporation | |

|---|---|---|---|---|

| Entity | KJR Management | KJR Management | KJRM Holdings | JMF / IIF |

| Object | Approval body for transactions with stakeholders that makes resolutions and reports on matters relating to internal compliance and its systems as an advisory body to the Board of Directors | To deliberate and make resolutions and reports on overall risks in investing and investment management policies, budgets, funding, acquisition/disposal/ investment management of assets, and investment effects, etc. | To make resolutions and reports on matters relating to the operation of the asset management business and real estate investment corporations, investment management business, investment advisory/agency and other businesses based on investment advisory agreements, and the Company | To make resolutions and reports on matters set forth in the Act on Investment Trusts and Investment Corporations and matters prescribed in the Investment Corporation Rules |

| Chair | Head of Compliance Office | President & CEO | President & CEO | Executive Officer |

| Members | President & CEO, Division Heads, external expert(s), and person(s) nominated by the Chair | Full-time Directors, Executive Officer controlling the Division in charge of fund asset management, Head of Compliance Office, external real estate appraiser(s), and person(s) nominated by the Chair | Directors nominated by the Board of Directors | Supervisory Directors |

| Frequency | In principle, once every three months | In principle, every week | In principle, once a month | In principle, twice a month |

The organization of each investment corporation consists of executive directors, supervisory directors, an Officers Meeting, which is comprised of all directors, a General Meeting of Unitholders, which is comprised of investors, plus an accounting auditor.

The number of directors and their compensation is decided by each investment corporation, and monthly remuneration is determined by the Officers Meeting. Pursuant to the ITA, investment corporations are prohibited from having employees. Accordingly, none of our investment corporations have any employees.

We strive to explain their investment policies to individual and institutional investors in an accurate and prompt manner. In doing so, we aim to maximize our value to our investors.

For details on information disclosure to unitholders, please refer to the “Disclosure Policy.” of each investment corporation.

We place importance on integrating consideration for ESG into investment and management processes, so as to improve the value of sustainable asset management and portfolios. We are also a signatory to and is participating in international initiatives.

Likewise, we aim to maximize unitholder value by means of external evaluations of sustainability activity and environmental certification of asset holdings. For more information, see the following“Environmental Approvals and Evaluations for Group Assets” and the “Supported initiatives”.